A US bank has unionized for the first time in 40 years

Roughly 100 Beneficial workers ratified a contract with management in late September, after agreeing to unionize in March 2020.

From Quartz at Work:

Like a growing number of companies these days, Beneficial State Bank promotes the idea of doing well by doing good. Founded in 2007 with a focus on community development and social and environmental justice, the company has $1.5 billion in assets and 13 branches in California, Oregon, and Washington. And now it’s the first US bank to establish a union in about 40 years.

Roughly 100 Beneficial workers ratified a contract with management in late September, after agreeing to unionize in March 2020. Labor organizers hope the agreement will set an example for customer-facing workers in the financial sector more broadly, who have been vocal in recent years about issues like wage inequality, racial bias, and the kinds of high-pressure sales goals that led to the Wells Fargo fake account scandal.

No doubt a union push will be a challenge at US banks, where fewer than 1% of workers are unionized. But Beneficial’s amicable unionizing experience points to a new way of thinking about organizing—one that may resonate with both workers and employers well beyond the financial sector.

Beneficial opened its doors to the union

Beneficial is a B Corp, meaning it’s been independently certified as prioritizing social and environmental issues and transparency, and is legally accountable to balance profit with purpose. It’s majority-owned by the nonprofit Beneficial State Foundation.

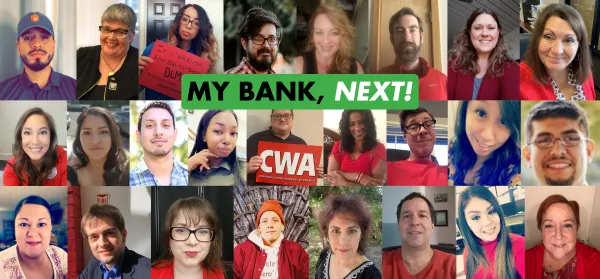

For years, the Oakland, California-based company has been involved with the Committee for Better Banks,,a nationwide campaign to improve working conditions for bank employees. Among the organizations involved in the Committee for Banking is the Communication Workers of America, which represents more than 700,000 machinists, flight attendants, writers, television production hands, and other employees from a wide range of industries. So communication lines were already open between Beneficial leadership and the CWA when organizers approached the bank in 2019.

“They said, we’re looking for a bank that is out there in front and leading the way, we’d love to be able to talk to your workers,” Beneficial CEO Randell Leach recalls.

When bosses don’t fear unions

The bank’s leaders coordinated with CWA union representatives to come in and to talk to employees about organizing—but, Leach emphasizes, “we didn’t choose or promote it to our employees.” Rather, management’s attitude was, “you’ve got the right for self-determination.”

It’s one thing for a company to voluntarily recognize a union once employees have organized—quite another to welcome organizers in for a chat. Even companies that pride themselves on being progressive—like the crowdfunding app Kickstarter, also a B Corp—can get spooked by the prospect of employees organizing.

Beneficial’s thinking on the matter was informed by managements’ faith that the organizing process doesn’t have to be antagonistic or divisive. If management is already treating workers well, Leach says, unionizing is “not something you should be afraid of.”

“Enlightened corporations that focus not just on profit maximization but doing the right thing … if you’re doing all that, then the union proposition is a different one,” Leach says. “It isn’t Hey, we’re getting in fights and arbitrating. It’s, okay, make sure there’s a structure for employees to have a voice and make sure we’ve got a process to go through.”

This is not the typical stance for a bank boss. Consider JPMorgan Chase CEO Jamie Dimon, who chaired the Business Roundtable when it released a landmark statement in 2019 committing America’s top corporate leaders to considering how their actions impact employees and society at large, rather than prioritizing shareholders’ interests above all else. When US senator Sherrod Brown of Ohio asked Dimon this May whether he would set an example for American companies by “pledging to remain neutral if your employees want to form a union,” Dimon simply responded, “No.”

Why well-treated workers choose to organize

A key lesson from Beneficial’s story is that workers’ decision to organize doesn’t necessarily mean they’re unhappy with their current working conditions. Desiree Jackson, an assistant vice president of treasury management services at Beneficial, says the idea of unionizing appealed to her largely because she wanted to preserve all the things she liked about working there.

“I worked at Wells Fargo for many years. And what I saw with Wells Fargo was no transparency,” Jackson says. When she joined Beneficial, she welcomed the company’s clear communication with employees and its close-knit culture.

But as the company grew, “I was afraid we were going to get away from our mission,” Jackson says. “The thought of losing that… When the opportunity to present itself to unionize happened, it was almost a-no brainer.”

That said, workers at Beneficial did have certain things they wanted to change. The new contract won employees a minimum wage of $20.50 per hour (and $28.60 in higher-cost areas like Oakland), a $1,000 signing bonus, and an increased employer match on employees’ 401(k)s, from 4% to 5%.

“The biggest win is that everybody’s happy now,” says Jackson.

The link between unions and conscious capitalism

The Committee for Better Banks, which helped organize the union effort at Beneficial, predicts that further organizing in the industry will be an uphill battle. Big bank workers in particular are “interested in unionizing, but there is going to be a fight,” says Nick Weiner, co-lead director of the advocacy group.

In the meantime, he says, the hope is that Beneficial’s unionizing process will inspire community banks and credit unions that are looking to “set an example of how a financial institution can operate ethically right now,” in which “respecting workers’ right to unionize is part of that mission.”

Bank employees who deal directly with customers “see the intimate connection between how they’re treated and how customers are treated,” Weiner says. “And so advocating and improving their situation will also help them better serve the best interests of their customers.”

The changed workplace

Even with a management team that was open to the process, it still took 18 months for Beneficial to reach a contract with its unionized workers. But Leach, for his part, suggests it may be time for companies of all kinds to reconsider outdated notions about unions, in light of the evolving power dynamics between employers and employees.

Rather than a hierarchical model, in which bosses set policies and standards that employees are expected to swallow whole in exchange for compensation, the contemporary workplace is increasingly a place in which employees expect to be in dialogue with company leaders. And the tight labor market is further fueling workers’ sense that they have an ability to push for things they want, from better pay and greater flexibility to more influence over their employers’ ethical decisions.

“The value proposition for unions is different in the white-collar industry than in the historical manufacturing setting,” Leach says. “But there’s always going to be a need for workers to have representation and voice and visibility. And unions are absolutely one way to do that, regardless of what the industry is.”

PRESS RELEASE: Communications Workers of America File ULP Against Wells Fargo for Refusing to Bargain with First Non-Branch Unit

Wells Fargo union accuses the bank of 'unlawful' tactics

Wells Fargo Bargaining Update: Rounds 1, 2, & 3